Below are commonly-asked questions about getting connected to Stripe to collect payments through OpenSports.

Can I change my Stripe account (link a different bank account to my OpenSports group)?

To change the Stripe account that is linked to your OpenSports group (i.e., change your linked bank account), message the OpenSports team: support@opensports.net

Is it normal for Stripe to request a copy of my photo ID?

Yes! Every user — whether an individual or a business — will need to upload a government-issued, photo ID in colour. It is part of Stripe’s obligations to their banking partners to verify a company representative on the account.

- Business accounts need to assign a company representative whose photo ID is used for verification. The company representative does not have to be the bank account owner.

Stripe does not request this photo ID immediately when you are activating your account. You will receive an email requesting this as soon as you have started processing payments. For additional help with this process, please reach out to the Stripe support team.

How do I view my account balance?

You can view your account balance through your OpenSports group Insights dashboard and your Stripe dashboard. To access your Stripe dashboard:

- Navigate to your OpenSports group dashboard.

- Click on Settings.

- Under the Payments heading, click on Stripe Account.

- Click on View Account Balanace to view your Stripe dashboard. You may be asked to log in to your Stripe account.

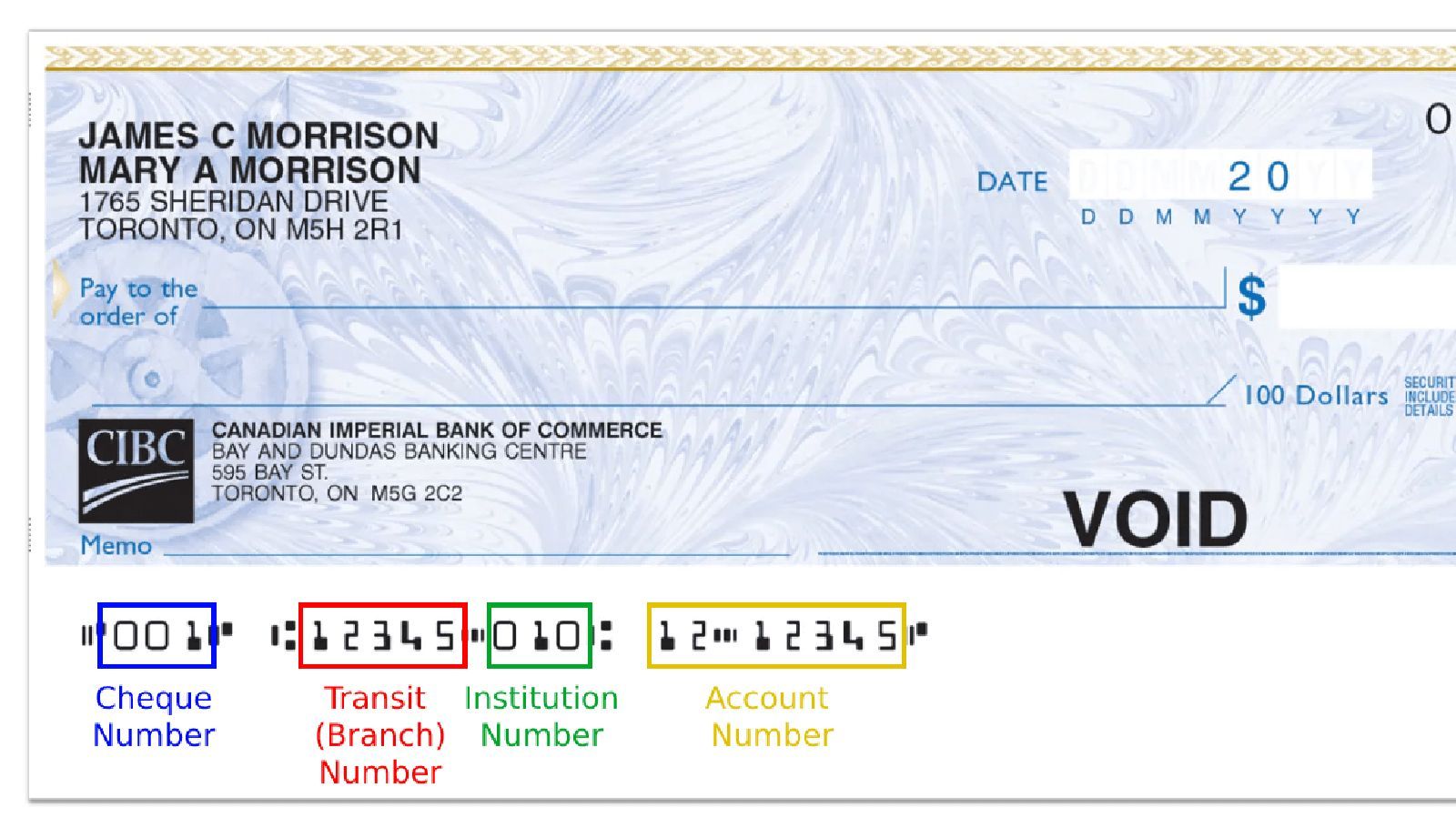

How do I find my transit number (Canada)?

Transit, Institution, and Account numbers work together to identify your account and ensure that your money ends up in the right place. These numbers are required to complete many basic banking transactions. You should be able to find your transit, institution, and account numbers by logging into your online banking account, or you can find them in your check book.

- The transit number (five digits) identifies which branch you opened your account at (often called your home branch).

- The institution number (three digits) identifies which bank you use (i.e., TD, RBC, Scotiabank, etc)

- The account number (seven to twelve digits) identifies your individual account. If your account number only has 6 digits but a form requires 7, simply add a 0 to the start. For example, 123456 is 0123456.

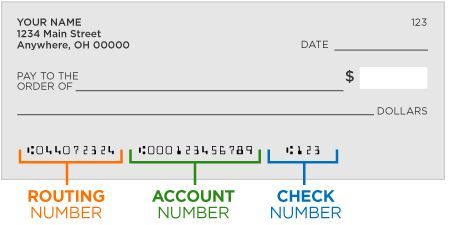

How do I find my account number (USA)?

Account and routing numbers work together to identify your account and ensure that your money ends up in the right place. Both numbers are required to complete many basic banking transactions.

You should be able to find your routing number and account number by logging into your online banking account, or you can find them in your check book.

The account number works in conjunction with the routing number. While the routing number identifies the name of the financial institution the account number — between 8 to 10 digits — identifies your individual account.

Is Stripe a secure system?

Stripe is an industry leader in online payment processing and takes security seriously. Here is an explanation from Stripe’s website:

Any organizaton involved with the processing, transmission, or storage of card data must comply with the Payment Card Industry Data Security Standards (PCI DSS). Stripe has been audited by an independent PCI Qualified Security Assessor (QSA) and is certified as a PCI Level 1 Service Provider. This is the most stringent level of certification available in the payments industry.

PCI compliance is a shared responsibility and applies to both Stripe and your business. When accepting payments, you must do so in a PCI compliant manner. The simplest way for you to be PCI compliant is to never see (or have access to) card data at all. Stripe makes this easy for you as we can do the heavy lifting to protect your customers’ card information.

In short, this means that OpenSports does not store or have access to credit card information entered into our platform because it is sent directly to Stripe.

What are transaction fees?

Transactions fees are charged by OpenSports and Stripe for every transaction processed through our platform. These fees allow us to provide you with the integrated features that streamline your sports and fitness group, program, league, and tournament management.

OpenSports Fee: OpenSports charges 3% of the transaction total. Stripe Transaction Processing Fee: Stripe charges $0.30 / transaction and a separate percentage fee, which varies by country. Visit Stripe's Pricing Page for detailed information on fees applicable to your country.

How to View Transaction Fees

Easily view your transaction fees through the Stripe Dashboard:

- Login to the Stripe Dashboard.

- Select a specific payment to view fee details.

- Hover over the ‘Info’ icon next to ‘Fees’ to see a breakdown of both Stripe and OpenSports fees.

Questions? Send them our way: support@opensports.net